Feasibility Study Consultants in Dubai, U.A.E

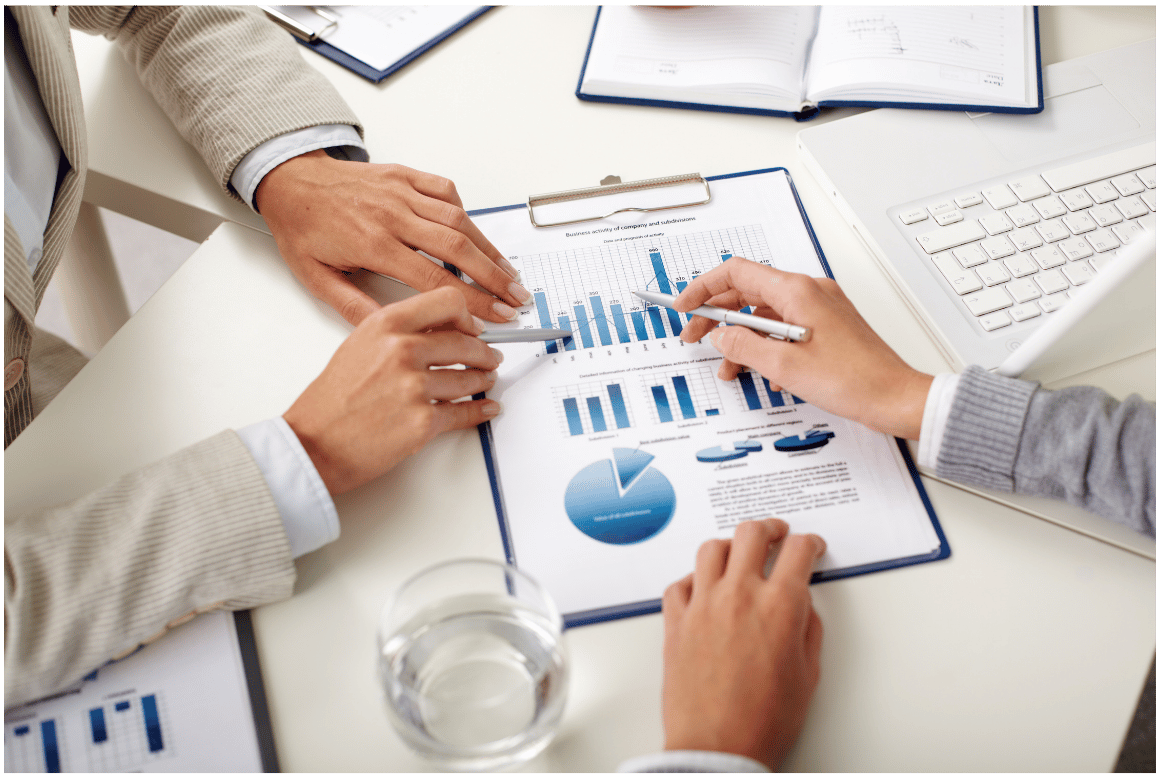

Kuvera’s feasibility studies are designed to validate the technical, financial, commercial, and operational viability of new ventures across the UAE and GCC region. Whether your company or Group is launching a new business venture, expanding to a new market, or executing a capital-intensive project; our experts bring strategic clarity at the earliest stages of planning.

We empower clients to make informed decisions with confidence. With a focus on investor expectations, long-term scalability, and regulatory compliance, our reports serve as a critical foundation for de-risking investments, building confidence among multi-level stakeholders, and successfully executing projects. Trusted by VC and PE funds, Family Offices & growing businesses in the UAE & Middle East. Secure strategic business valuation for your investment goals.

Why Invest in Feasibility Studies

In the Middle East, investing in the right project at the right time can define long-term success. Businesses across sectors such as manufacturing, real estate, healthcare, education, logistics, renewable energy, and technology must navigate regulatory frameworks, shifting market trends, region-wise customer requirements, and funding constraints.

We provide a proactive, data-driven approach that helps organizations plan rigorously, improve resource allocation, understand project complexities, and implement strategic objectives for financial success. Our methodology integrates regional tax compliance and tax advisory expertise.

Beyond internal confidence, these studies also enhance credibility with investors, private lenders, banks, and regulatory bodies, laying the groundwork for successful project execution and long-term resilience in increasingly competitive sectors.

How We Support Your Vision

Kuvera’s reports are built around the realities of doing business in the UAE, KSA, Oman, and the wider Middle East. Our team combines sectoral expertise with financial advisory capabilities to deliver strong insights.

Our core offerings include:

- Market Sizing, Market Assessment & Demand Forecasting

- Technical and Operational Feasibility Assessment

- Regulatory & Legal Environment Overviews

- Business Model Design and Financial Viability Analysis

- SWOT and Risk Mitigation Planning

- Investor-Grade Reports with Executive Recommendations

We work hand-in-hand with Corporate Leaders, Founders, Investors, Groups, and Family Offices.

Every industry presents unique challenges, risks, and opportunities. Our solution entails –

- Sector-specific research and market assessments

- Technical, operational, and regulatory feasibility

- Financial modeling and scenario-testing

- Commercial model alignment with local demand

- Localization for GCC market conditions

- Validation frameworks tailored to investor needs

We understand that business needs vary by stage and scope. Our feasibility studies can be commissioned as-

- One-off feasibility reports for investor readiness

- Embedded support in business formation or expansion

- Advisory add-ons (financial modeling, business planning, etc.)

- Multiphase studies for multi-market rollouts

Our feasibility studies are crafted to meet the expectations of investors, lenders, and board-level stakeholders and include –

- Executive summaries tailored for investor presentation

- Positioning the project to onboard new investors

- Financial projections for long-term operations

- Sensitivity analysis to reflect risk-return scenarios

- Visuals, charts, and data storytelling for clarity

- Benchmarking against regional and global comparables

We go beyond template reports and our approach is rigorous and grounded in regional intelligence –

- GCC-specific expertise and execution readiness

- Insight-led recommendations, not just observations

- Clear, concise, and investor-grade reporting

- Integrated financial and strategic advisory

- Proven track record across traditional and emerging industries

Robust Valuations and Sharper Insights

Discounted Cash Flow (DCF)

Comparable Company Analysis (CCA)

Precedent Transactions

Venture Capital (VC) Method

Relative Valuation

Discounted Cash Flow (DCF)

Comparable Company Analysis (CCA)

Precedent Transactions

Venture Capital (VC) Method

Relative Valuation

Why Kuvera Consulting?

Your Questions, Answered

What is a feasibility study and why is it important?

A feasibility study is a detailed evaluation that assesses the practicality and potential success of a proposed project or business idea. It helps decision-makers understand key factors such as market demand, financial sustainability, operational readiness, and potential risks before making critical investments.

When should I commission a feasibility study?

A feasibility study should ideally be conducted at the earliest stages of planning. It is especially valuable before launching a new venture, entering a new market, committing capital, or approaching investors or banks for funding.

What industries does Kuvera specialize in for feasibility studies?

Kuvera works across a wide range of industries including real estate, healthcare, manufacturing, logistics, hospitality, education, technology, and renewable energy. We tailor each study to reflect the specific dynamics of your industry and region.

How long does a typical feasibility study take?

The duration depends on the scope and complexity of the project. Most feasibility studies are completed within three to six weeks. However, larger or multi-phased projects may require additional time, which we define clearly during the initial scoping.

What makes Kuvera’s feasibility studies different from others?

Our studies are highly customized and grounded in real market data, regulatory understanding, and financial insight. Rather than using generic templates, we produce investor-grade documents that support strategic execution and stakeholder alignment.

Can Kuvera assist with implementation after the feasibility study?

Yes, our role often extends beyond the feasibility stage. We support clients with business planning, investor outreach, licensing processes, financial modeling, and early-stage strategic decisions to ensure continuity and results.

Do I need a feasibility study if I already have a business plan?

Yes. A business plan outlines your strategy and goals, while a feasibility study validates whether those goals are achievable based on data-driven analysis. It helps strengthen investor confidence and minimize costly missteps.

How does Kuvera handle studies for startups with limited initial data?

We work closely with startup founders to build feasibility assessments using market benchmarks, primary research, and available internal inputs. Our team is well-versed in navigating early-stage ambiguity with structured and adaptive methodologies.

Is a feasibility study useful for investor or lender presentations?

Absolutely. Our studies are designed to support funding conversations by providing comprehensive market analysis, financial projections, risk assessments, and investment rationale. They help strengthen your case and improve engagement with stakeholders

Can I commission a feasibility study focused on just one area, like market demand?

Yes. We offer modular study options that allow you to focus on a specific need such as market sizing, pricing analysis, or location feasibility. This provides flexibility without compromising on quality or insight.

AI-enabled M&A Technology Platform

(Under New Build)

We leverage cutting-edge technology to streamline M&A processes, enhance decision-making, and accelerate value creation. Our platform will empower you to make data-driven choices, optimize capital allocation, and achieve successful deal outcomes. This innovative approach is integral to Kuvera’s transaction support services in the future.

| Thank you for Signing Up |

| Thank you for Signing Up |

| Thank you for Signing Up |